Axa is one of the leading banks in Belgium that focuses mostly on helping clients, both retail and SME customers, with their loan applications. They currently hold a significant market share in providing loans for private individuals and lately they’ve also seen noteworthy growth in the SME and investment markets.

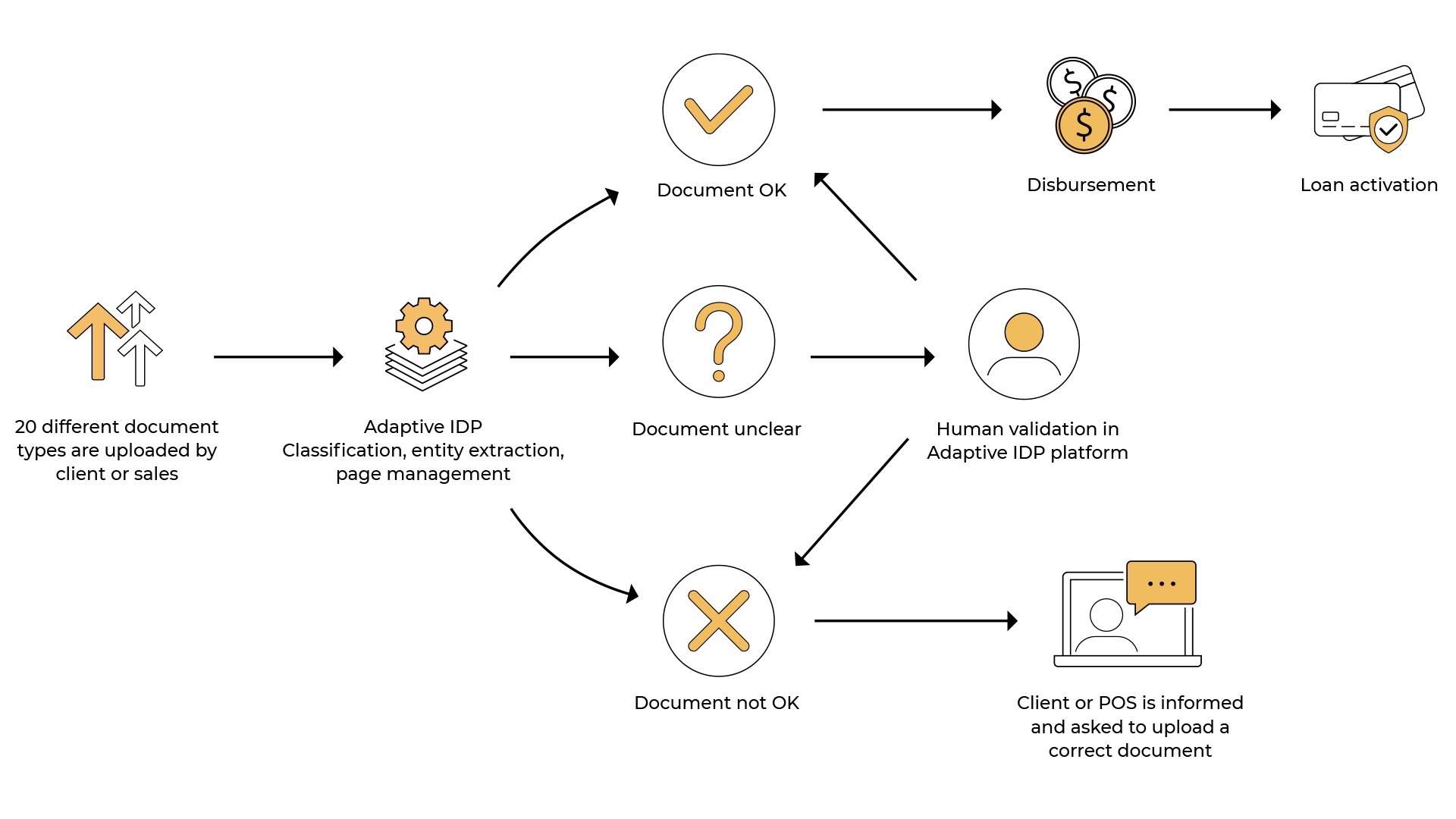

They wanted a way to streamline the loan application and approval process to free up their back office while improving customer experience.

“We decided to help our clients as fast as possible when they requested it, which meant that we needed to optimise for operational efficiency.”

Axa chose our adaptive Intelligent Document Processing (IDP) technology because the combination of optical character recognition (OCR) and machine learning technology was a ‘game changer’. Pure-OCR solutions still require heavy manual intervention, as the user has to ‘point’ them at the areas of a document where the relevant information is located.

Duco, by comparison, can adapt to new layouts to identify and extract the important information with 96% accuracy. Even where the team still has to intervene manually, it only takes them one minute per document, because the platform has done the bulk of the work upfront.

Axa have been able to cut loan application processing time by 50%. All this frees up their team to focus on delivering an even more efficient and responsive customer experience.