T+1 settlement: 3 big talking points

If your firm is in scope for T+1, no doubt the 28 May 2024 deadline is looming large in your mind. Earlier this month we gathered a panel of experts to talk about the steps they need to take to be ready for the change.

We started by asking our audience of over 120 buy and sell side practitioners three questions to assess their main challenges, current readiness levels, and whether they are looking at T+1 in North America in isolation, or as part of a wider global move to shorter settlement times.

The insights we gathered from the panelists as well as the audience provided some ideas on the way forward. Read on to see what we discussed.

The main challenges of T+1

The first thing we asked our audience was “What is your greatest concern about T+1?” The results are below.

Pressure on manual processes

Across both buy and sell side firms in our audience, by far the biggest worry was the pressure on manual processes that the new settlement timeframes will exert. Over 40% of buy side respondents chose this option, while it was nearly 50% for sell side firms.

This isn’t surprising. The trade settlement lifecycle is complex and multifaceted – there are pinch points around securities lending, collateral management and other ancillary processes. This loop is usually heavily manual, and is particularly reliant on the T+1 part of a T+2 settlement cycle.

With the move to T+1, firms will lose half of that window. So they’ll need to optimise intraday processes, thinking from the start of the allocation process for the institutional flow, all the way to the daily 7pm allocation and 9pm affirmation deadlines.

Large number of trade fails

Firms are also concerned about the large number of trade fails they foresee because of the shortening of the settlement timeframe. 26% of buy side firms picked this as their greatest concern, alongside 21% of sell side respondents.

Trade fails can happen for a range of reasons. Two of the most prominent are inventory issues, where firms can’t deliver securities on time, and bad data. Both can have serious knock-on effects that will ultimately eat into the bottom line.

With T+1 cutting timeframes in half, there will be less time for firms to handle these inventory or data issues, leading to increased trade fails across the board. Firms will need to ensure that their post-trade processes are fit for purpose.

Counterparty readiness

Coming just behind trade fails, firms are also concerned about the readiness of their counterparties and clients for the new settlement timeframe. This was chosen by 20% of buy side respondents and 13% sell side.

There’s a lot of outsourcing in a front-to-back process model, and many firms rely heavily on trading counterparties and prime brokers. This means that they’re exposed to upstream processes needing completion before being able to take the reins and do their part.

Diagnosing the health of your T+1 operating model and understanding where those pinch points are will be incredibly important in getting fit for T+1. Buy side firms will need to engage with their custodians, agents and brokers, encouraging them to weave readiness into their parts of the affirmation process.

How to accelerate your readiness level

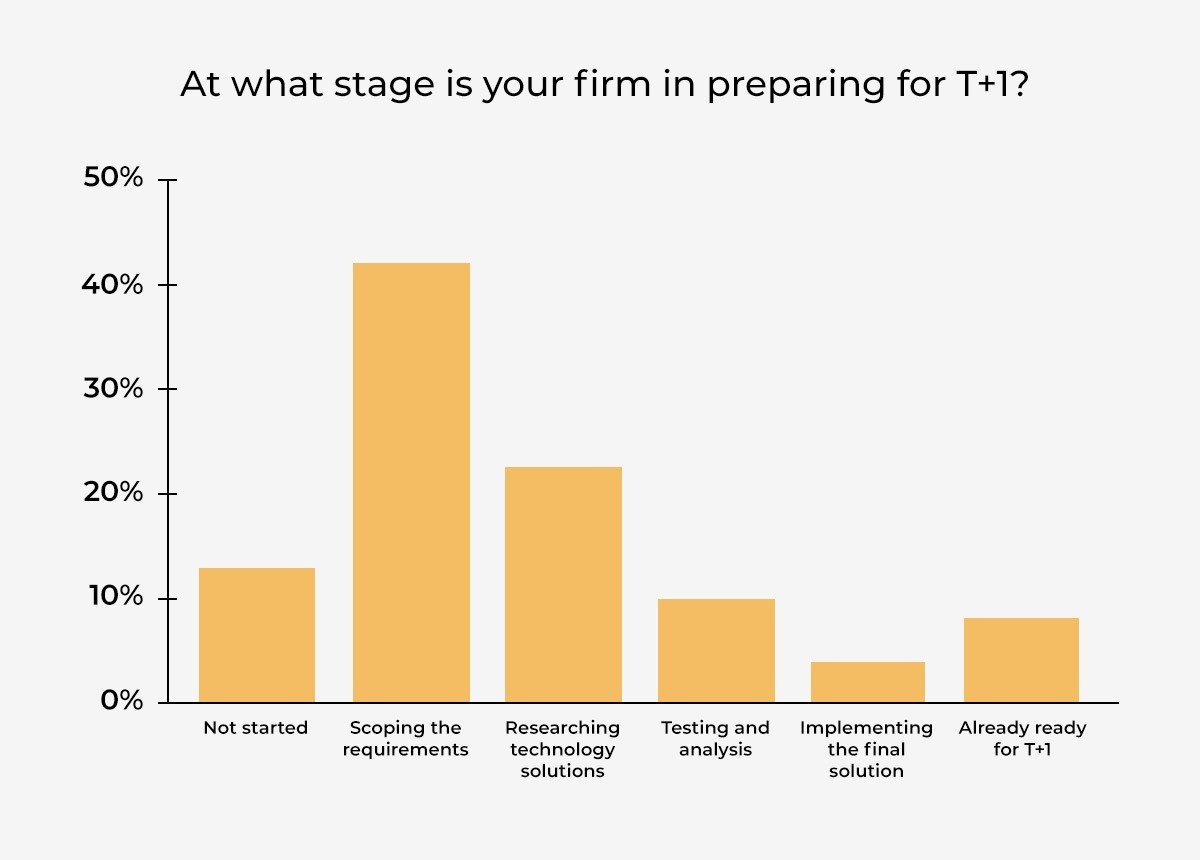

The next question we asked was “At what stage is your firm in preparing for T+1?”

Surprisingly, 13% of respondents had not yet started on their T+1 preparations, while the most popular answer was “Scoping the requirements” with 42% of the vote.

Our panel was expecting a larger percentage of the audience to be further ahead with their preparations, and so this led to a discussion over what firms need to get in place now, to help them ensure compliance.

Tailor your controls to your environment

Firms are very likely to have a bespoke processing infrastructure for booking trades and handling the trade lifecycle. Likewise, the customer base and business model will be different between firms.

While it might sound obvious, the first step to building a strong control layer is understanding that unique environment. Organisations can sometimes fall into the trap of building a control framework that perhaps they’ve seen elsewhere, and end up with something that doesn’t correlate to their business model.

Once you have a clear understanding of your control environment and how it functions, moving forward and putting control enhancements on top isn’t nearly as hard. But miss the first step, the front-to-back understanding, and it’s not always clear what you’re solving for.

Prepare to change your operating model

T+1 leaves no time for time-consuming, error-prone manual processes. You’ll need to drill into what elements are manual currently, and optimise your front-to-back processes with automated T+1 reconciliations. Timelines are squeezing to 7pm every day, and you’ll need to meet these to be in the spirit of the regulation.

Similarly, while the affirmation process wasn’t mandatory before, the SEC has been quite clear on what it wants to see by 9pm every day. This brings its own operational challenge – to handle the deadlines you’ll need to bring in brand-new controls or ring-fence resources. Will your teams work later? Will you use teams in a different timezone?

What’s more, client onboarding reference data will now need to be reported on the same day. This brings plenty of data and reconciliation challenges for KYC, onboarding and middle office teams. You’ll need a solution that enables these teams to work together, quickly and efficiently, to meet the new deadlines.

Moving towards a global operating model

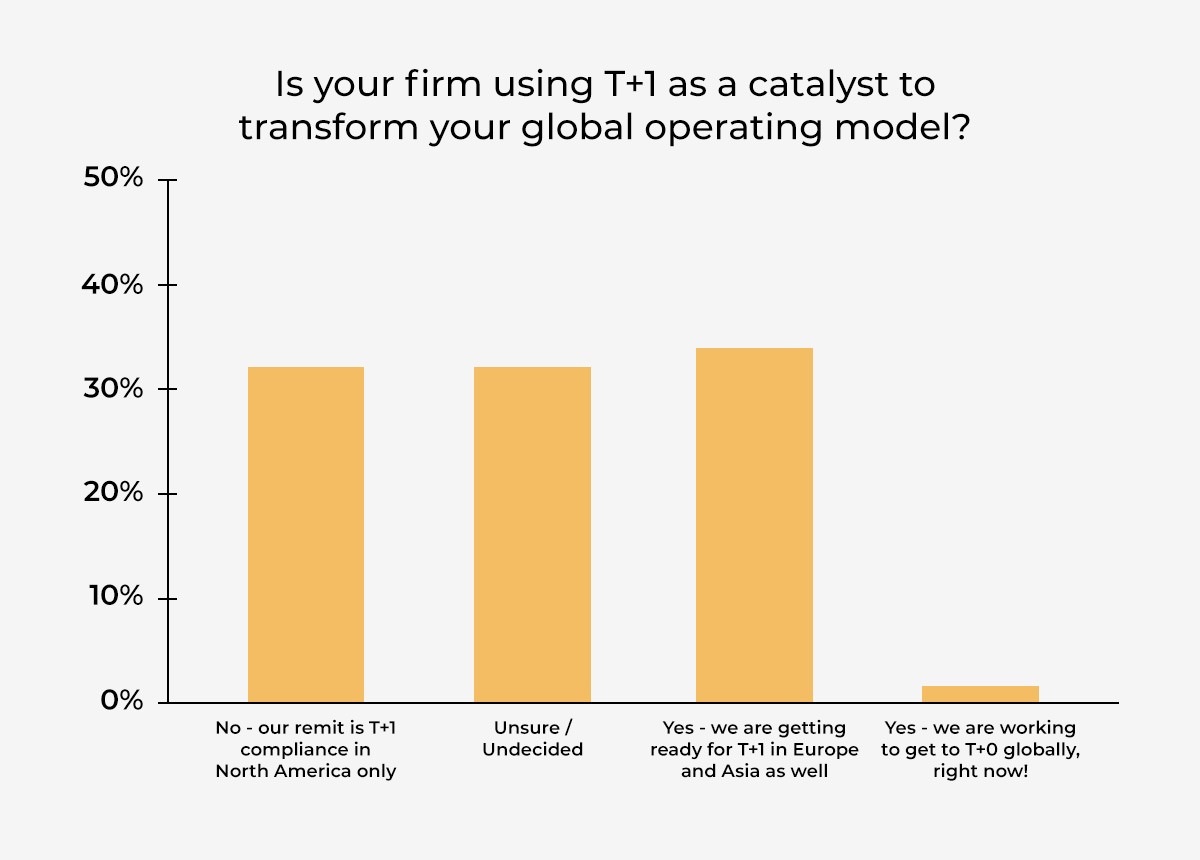

The final question we asked our audience was “Is your firm using T+1 as a catalyst to transform your global operating model?”

About a third of our audience replied that they were looking to comply with T+1 just in North America, while another third were looking to get ready for future changes to T+1 in Europe and Asia as well. The remainder were unsure/undecided, apart from 2% working towards T+0 globally right now!

T+1 in North America is just the beginning

What’s clear is that a broader part of the industry seems to be moving towards shortening timeframes for settling trades and transactions.

We’ve seen timescales cut for uncleared margin rules and transaction reporting, and it’s widely expected that European and Asian regulators will follow North America in pushing for T+1 settlement for securities.

A key part of dealing with shrinking timeframes is moving away from process ownership – such as a reliance on exceptions management – and towards data ownership.

If, for example, your firm is dependent on exceptions from reconciliation processes to find out what’s wrong with your data, in a T+1 scenario, you have very little time to fix the problems. And a major problem if errors and/or volumes spike.

With a data-centric approach however, you can start putting data validation and quality controls upstream, so any errors are caught at source, before they generate exceptions. You can spend effort and resources making sure the data that enters your systems passes accuracy and completeness checks, rather than scrambling to fix a load of breaks in a tight timeframe when bad data appears.

For decades, the cost associated with bad data has been a hot topic in our industry. But without context, it can be hard to define that cost. T+1 is a great example of how bad data can drive that cost, and a fantastic opportunity to move toward a more data-driven way of thinking.

How can Duco help your firm with T+1?

Wherever you are in your T+1 preparation cycle, Duco can help you get ready, get compliant, and start moving towards a more data-centric operating model. We offer a range of T+1 services and can:

- Diagnose your architecture and controls to understand where your needs are

- Scope and build agile controls to normalise and reconcile your data within the new compressed timeframes

- Help you develop an operating model that can help keep you compliant, with full transparency and auditability

For more information, go to our T+1 Operational Readiness page

*Poll data is based on 127 live webinar participants with 86% responding across the buy and sell side.