Fast, accurate

cloud-based

reconciliation software

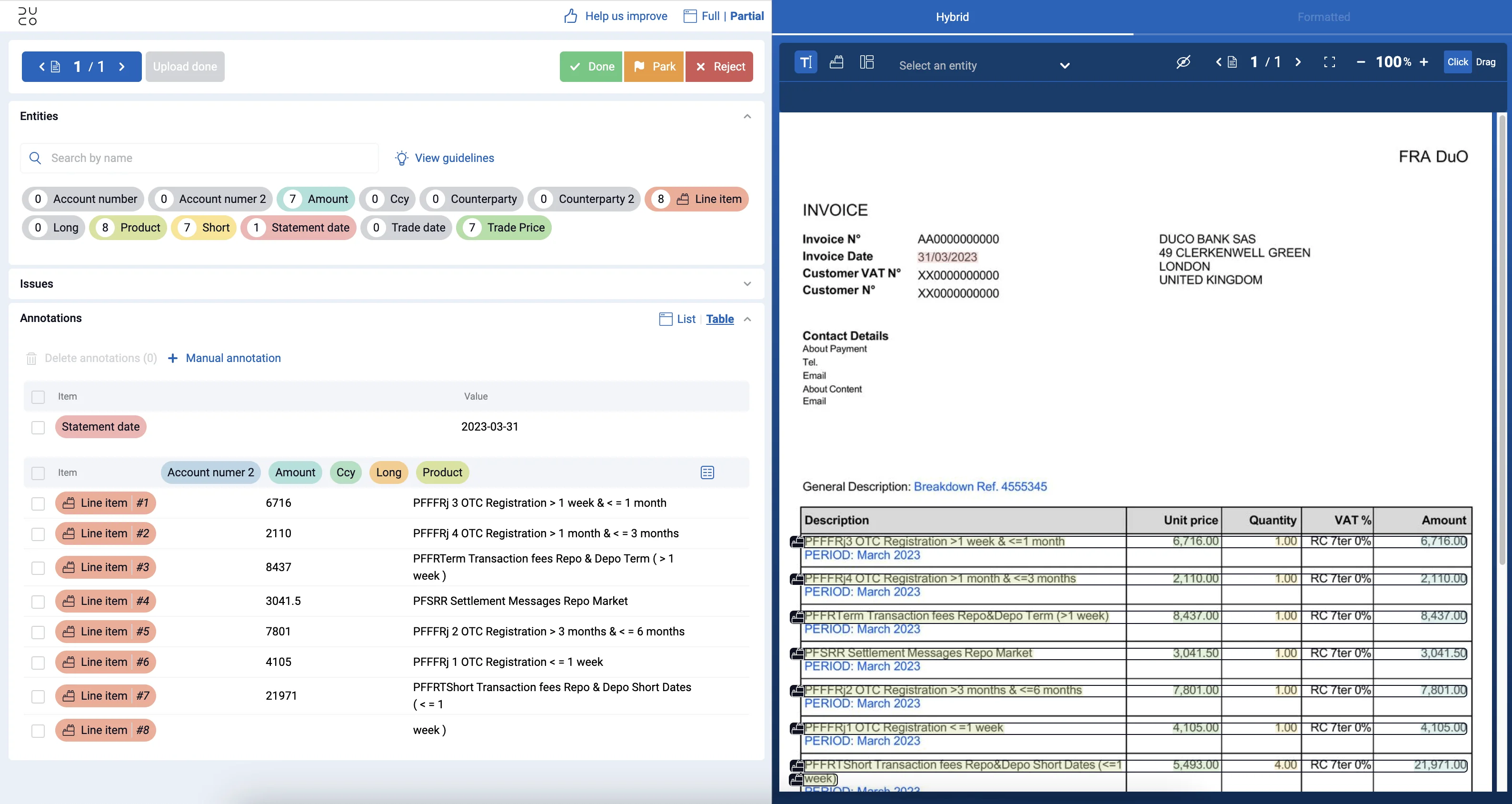

Overhaul your reconciliations for speed, flexibility and control. See how Duco's software helps simplify reconciliation, matching structured or unstructured data, quickly & accurately.

Trusted by

10X BETTER RECONCILIATION

We don’t believe in delivering incremental benefits. Duco’s industry-leading match rates, AI-powered tools, and unrivalled no-code, cloud-native expertise deliver results that are orders of magnitude better than other solutions.

10X faster setup times

Average rec build time on hard-coded, on-premise tools is 74 days (source: Aite Group). With Duco it’s 5, and can be as little as 3 hours.

10X rec reduction

Duco does it once, and gets it right. Clients migrating from other solutions have reduced their reconciliation count by over 90%.

10X less break noise

Industry leading match rates and no-code automation cuts false exceptions by up to 90%, dramatically reducing investigation work.

RECONCILIATION. SIMPLIFIED.

Structured or unstructured data

Bring any type of data, from flat, CSV and ISO files to PDFs, emails or images! Duco’s market leading data extraction and adaptive IDP technology means you don’t need to rely on manual extraction or expensive ETL tools.

AI-powered setup

Slash setup time with AI-powered match field prediction and our new agentic rule builder. Set up reconciliations in half the time, keeping humans in the loop to validate outcomes and train the models for better results in future.

Best-in-class matching engine

Best-in-class match rates, fuzzy matching and user-managed tolerances filter out noise so teams can focus on real mis-matches, rather than formatting or rounding issues.

Automated exception management

AI and rule-based exception management capabilities automate everything from labelling & commenting to assigning for investigation. Getting you to better data faster.

Total visibility for greater control

Understand where breaks are occuring and how your Duco processes are performing with in-platform MI. Access historical data to visualise in tools like Tableau and Power BI for reporting and trend analysis.

We looked at a number of systems but Duco stood out for its agility and SaaS deployment model. It is the only solution that truly empowers our Operations team to build and manage reconciliations themselves.”

“We have been particularly impressed with the flexibility of Duco and the speed with which we were up and running. The platform was able to handle complex data straight out of the box, enabling our operations teams to start setting up controls themselves with minimal training.”

“We are very impressed with Duco as a valuable reconciliation tool. We’ve been rolling it out across increasing product areas globally and have seen significant efficiencies already.”

Stay on top of the biggest topics and technology trends impacting the industry.

Explore all our expert insights here.

That free reconciliation tool you have is costing you a fortune

Getting a free reconciliation tool seems like a win. But where great recon software creates value, freemium offerings usually come with hidden costs.

Winner's profile: Waters Rankings 2024

We won Best Reconciliation Management Provider for the second consecutive year in the Waters Rankings. Discover why the industry backs Duco.

The Reconciliation Maturity Model

A roadmap to beating your long standing financial reconciliation challenges for good. Benchmark your firm against best practice and discover a path to efficiency with the Reconciliation Maturity Model guide.

Reconciliation Software FAQs

-

What should I look for when purchasing reconciliation software?

There are some characteristics that all good reconciliation software should have, regardless of your particular use case or business setup. These observations come from our years of experience dealing with financial firms of all sizes across the globe. The following features are vital to ensure you get the most from your reconciliation platform:

Flexible ingestion: Look for a tool with the capability to ingest data in many formats. Good reconciliation software will remove the ETL layer and provide capabilities to prepare data as well as ingest it.

Best-in-class matching: Match rates are vital. A solid reconciliation tool should have fuzzy matching and rule-based tolerances to filter out false breaks due to formatting or rounding. It should also have strong controls around these rules to ensure auditability.

Ease of building and managing: Platforms where business users who know the data can build and modify processes will save time, money and headaches. Avoid systems that require massive change projects just to build or change a rec.

Exception management capabilities: Ease of use is the name of the game here. No matter how good your match rates are, you’ll still have to manage exceptions. The ability to label, comment on, assign, and resolve exceptions from one screen is vital. Automated or rule-based exception management is even better.

Reporting capabilities: The ability to feed data downstream and view status and results on a dashboard is key to oversight and identifying the trends that signal upstream problems.

Total cost of ownership: Consider upgrade costs, maintenance costs, IT and project costs, and intangible or opportunity costs. A cloud-based solution, for example, will cost you significantly less than an on-premise deployment, while providing much greater scalability.

-

How can reconciliation software like Duco help me?

Duco enables you to have confidence in your data by checking its accuracy, flagging any discrepancies and providing a streamlined workflow for resolving breaks. The platform combines data preparation, normalisation, validation and reconciliation, giving you a transparent and auditable view of the end-to-end process lifecycle.

Beyond this, the Duco platform’s ability to focus on genuine reconciliation breaks, by removing the ‘white noise’ of false breaks and automating the resolution of routine exceptions, allows our customers to shift their focus upstream. They are able to fix data quality issues at source, permanently removing bad data downstream. This ensures that they can trust their data and removes the need for extensive and expensive manual intervention.

-

How long does it take to get reconciliations up and running on Duco?

Implementing the Duco can be done in a matter of days without large IT projects. The platform is Software as a Service (SaaS) so is available to use almost immediately, with no installation needed. Then, depending on the complexity, you can build a reconciliation from scratch in a matter of hours.

More complicated reconciliations can take a few days or a few weeks, depending on your internal processes and requirements.

Duco can be completely self-service, but – for added speed – you can also take advantage of our professional services capabilities, where our reconciliation experts can help you build and deploy your reconciliations.

-

Why should I consider a cloud-native/SaaS reconciliation solution?

You can respond much quicker to changing business needs with a SaaS platform, enjoy significantly lower total cost of ownership and easily access the latest tools and capabilities. As a Duco customer you’ll benefit from continuous innovation, with new features and improvements rolled out seamlessly on a monthly basis.

It’s also easy to adjust your usage of the platform, scaling to meet new volume or use case requirements, or to serve different teams and geographies. Compare this to an on-premise deployment, where not only do you have the cost of hardware and maintenance, but also changes/upgrades require major and expensive IT projects.

-

What can I do with the data captured in Duco?

Once the data is reconciled, you can use Data Platform to pull the data, breaks and workflow information into visualisation tools like PowerBI or Tableau, feed it into Excel or SQL databases, or push it to other internal systems or reports.

Duco stores several years’ worth of historical data so you can use it to spot trends and identify points of failure in processes. You can also export the data to upstream processes or downstream for other reporting purposes.

-

Can I schedule my reconciliations?

Yes! With Duco you can schedule data prep processes and reconciliations to run at specific times of the day, or when pre-defined levels of data have been received from counterparties or internal teams.

-

Can I see a demo with my own data?

Absolutely. Contact us to discuss your reconciliation needs and schedule a demo.

-

What are the biggest challenges with data reconciliation?

Data reconciliation has many challenges, but two of the biggest are data quality and transparency and auditability.

Data quality

You’re almost never reconciling data sets that are perfectly clean and aligned. You receive data from various sources with formatting differences – for example, one file denotes currency with a symbol, another with the three letter code, dates are in multiple formats, and frequently some data is missing. This requires a lot of work to get the data into shape before you can even think about reconciling it. That may be done with macros, manually, or with an expensive point solution.Transparency/auditability

If you’re reconciling data in spreadsheets or using manual interventions to get data in shape (as above), you introduce the opportunity for human error. As data is added and normalised manually, mistakes can happen, and they’re frequently not found until much later. It can be bad for your day-to-day operations, but even worse when you’ve got to deal with an audit.With automation platforms like Duco, messy data is no problem. You can clean up your data in the platform, without separate solutions, quickly and easily. And every action you take is self-documented automatically in a PDF. So you – and regulators – can see exactly how the data was processed.

-

What is the main challenge with account reconciliation?

Many accounting tools provide reconciliation capabilities to enable you to compare your general ledger to bank statements, but they are frequently not robust enough to handle the various formats that come in without specific APIs. This means you spend time managing spreadsheets, and slowing down your processes. Which can be a problem, as reconciliations need to happen accurately and quickly for reporting and cash management purposes.

Duco can manage multiple data formats without the need for specific APIs. Data in PDFs, SWIFT formats, and excel or CSV files can be uploaded as is and normalised in the platform. And Duco’s best in class matching engine means you filter out the noise of false breaks, getting to the right data, faster.

SEE WHAT’S POSSIBLE WITH DUCO

Download our case study to see what you could achieve when you unleash your data potential with Duco.

Unlock the power of your data with Duco

Fill in the form to watch an extended demo of the Duco Platform in action.