How Public Sector CFOs Can Manage Trillions in COVID-19 Funds

COVID-19 stimulus packages are resulting in a significant amount of money entering the global economy. Public Sector CFOs must make sure robust financial controls are in place to handle the influx.

By Dave Hannibal, Global Head of Strategic Partnerships and Alliances at Duco, and Keith Nelson, Senior Director, Public Sector at Automation Anywhere

As of late March, China, Hong Kong, USA, UK, Austria, South Korea, Australia, Germany, France, Italy, Japan, Canada, Russia, India, and Brazil have introduced some form of stimulus package to help mitigate the financial effects of the COVID-19 pandemic.

The type of funds these countries are introducing into the global economy includes cash payments to citizens, funding of state, regional and civic governments, relief for small and large businesses, support for the medical community, and direct purchases of medical supplies.

Introducing this money into the economy means new cash flows, payments, and goods are running through new supply chains. To ensure the funds serve their intended purpose, financial control is paramount. For more on financial control, please see The Powerful Role Reconciliation Solutions Play in Financial Control and RPA Bots Can Reduce Fraud in Coronavirus Scams.

New cash flows mean new control headaches

Tracking the injection of capital into the system through the general ledger to subledgers, from federal to state and local jurisdiction, from public service bureaus to businesses and citizens, as well as separating these flows from the everyday baseline financial flows of government adds massive burdens on the system. This is no easy task with significant consequences if not structured correctly.

The risk of errors around these funding flows could translate into hospitals receiving capital too late to obtain new life-saving equipment, supply chains not transferring or having goods stolen along the way, businesses not being paid for their services and going bankrupt, or capital going to the incorrect party and being the subject of a future finding by the Inspector General.

The situation is evolving fast and calls for powerful technology that can be deployed immediately to get these potential issues under control. There is no time for complicated implementation projects.

Before COVID-19

Traditionally, under more routine stimulus-funding environments (say, disaster payments after a hurricane), government workers would take manual extracts out of core systems to run comparisons and report back to management on the status of the stimulus program. These reports are needed to ensure the results from:

- General ledgers (GL) and compare that data to other GL statements, i.e. bureau to bureau, federal to state, state to municipality

- From GL to sub ledger, i.e. bureau to bureau, federal to state, state to municipality

- Invoice to payment or payments sent to bank statement

Supply chain comparisons of goods sent vs. received

These manually-run extracts would then need to be reconciled in Excel and tracked. The workers tasked with the process would begin the tedious task of combing through all the data before sending out reports to senior management.

Today’s world

Now, with the influx of so much capital being moved around, the task of financial control is simply larger than what humans can reasonably manage. There are more people, data, and financial risks than any system can absorb.

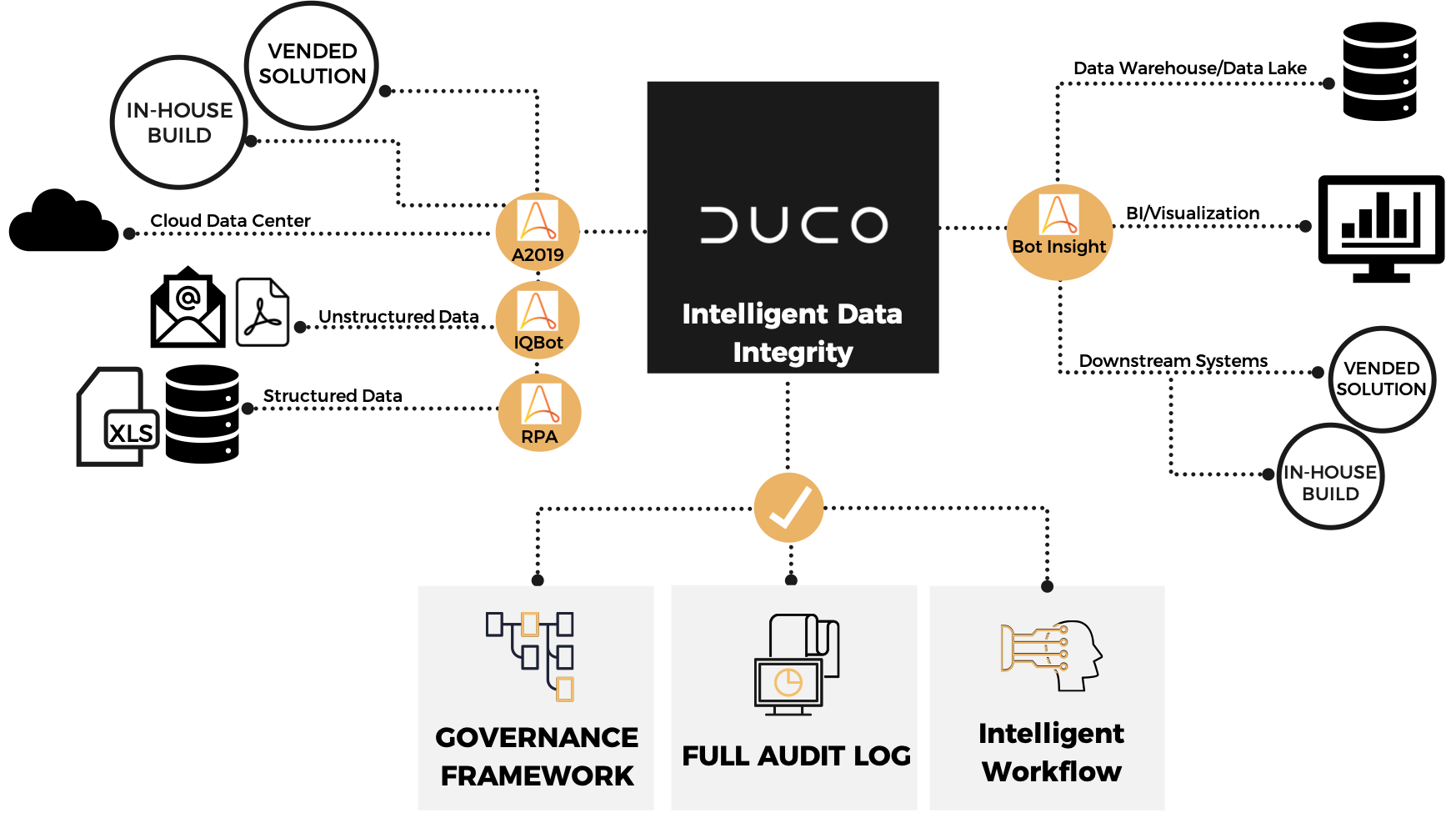

However, by using Automation Anywhere and Duco, public sector departments and bureaus can quickly automate this process and create near real-time transparency into every aspect of the stimulus money. Government agencies can leverage this solution to automatically:

- Extract payment and GL data, convert unstructured invoices or payments into structured data, and parse textual data into readable data with Automation Anywhere

- Feed the extracted data into Duco

- Normalize, transform, reconcile, and match GL, subledger, payments, and statement and invoice data

- Provide exceptions management workflow to automatically label, assign, and route exceptions and breaks to the right users or bots

- Create dashboards and analytics

- Route outputs to downstream systems

Conclusion

In today’s day and age, governments should take advantage of all available technology to ensure speedy and accurate delivery of service to its citizens. Modern technology tools can bring automation, efficiency, and financial control to the massive global influx of new capital, even with the high amounts we are seeing around the world.

Because time is of the utmost importance, the public sector needs solutions that can be activated in days, producing results in weeks, with enough resilience to last the multi-year duration that stimulus funds tracking will require. There is no time for training. The Automation Anywhere and Duco solution can be activated by financial business users without the burden of learning a new financial management system.

Duco, in partnership with Automation Anywhere, is here to assist with implementation, coordination with IT, and onboarding to boost your efforts and help you reach your goals faster.

To learn more about fast-tracking your approach to financial control, please contact us.