EMIR Refit: Four polls that show how firms are preparing

By Rewan Tremethick, Content Manager.

How are firms preparing for the EMIR Refit, what are they concerned about – and what should they be concerned about?

Our latest virtual event on the EMIR Refit covered this and more. Our host, Duco’s Global Head of Client Engagement, Carly Van Kirk, and panellists Steve Walsh, Duco’s Director of Product and Solutions, and Stephanie Rubizhevsky, Director at Quorsus, polled our audience on four areas of EMIR preparedness.

Here’s what we discovered about the industry’s top challenges and concerns, and what our experts recommended.

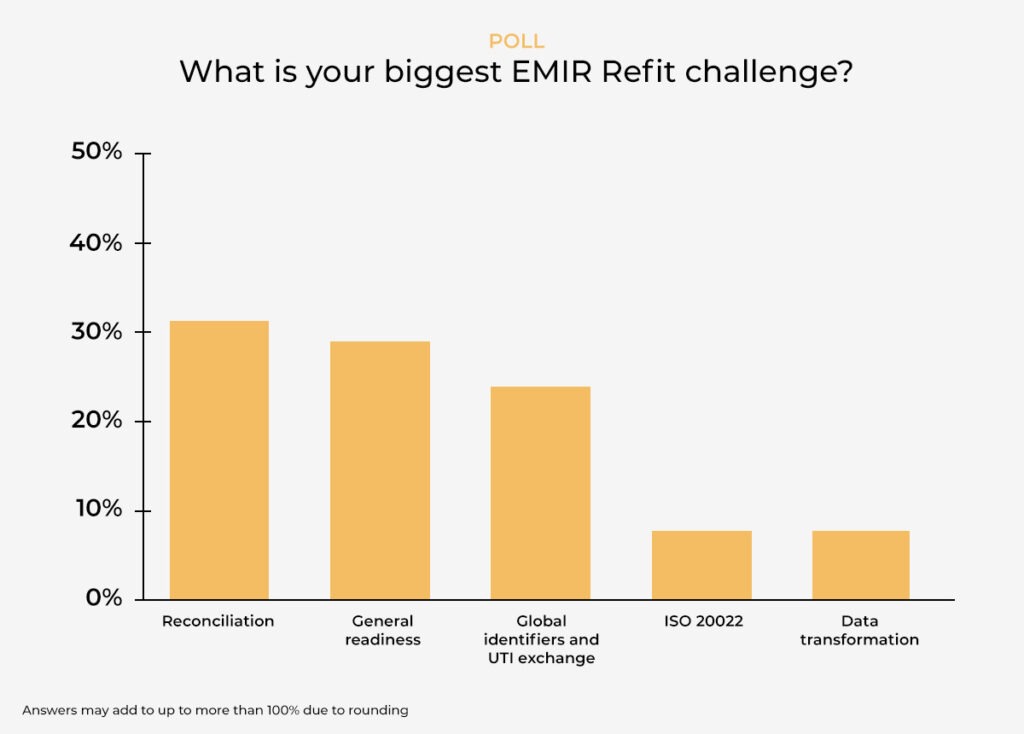

Reconciliation tops EMIR Refit challenges, but firms are concerned about general readiness too

Our first poll asked our audience what their biggest challenge was, given that we’re only six months out from the EMIR Refit. A lot of attendees were concerned about their general readiness (29% of respondents), but reconciliation topped the list with 31% of the responses.

‘Though there will be a gradual roll-in on the requirements for reconciliation, a robust control framework from day one is absolutely essential,’ Steve said, adding that it’s fundamental that firms are ‘able to illustrate the plans on the resolution of issues.’

He pointed out that the EMIR Refit is bringing a huge number of changes to reporting fields, from the addition of new fields to changes to existing ones.

‘When it comes to data,’ Steve explained, ‘new fields and changes to existing fields will require data interpretation, normalisation, determination, and ultimately ingestion. Readiness requires extensive UAT [user acceptance testing] and format validation with your chosen TR [trade repository]. This is no easy undertaking based on the data elements and data implementation plans that we’re seeing.’

Stephanie noted the importance of thinking long-term and globally when preparing for the EMIR Refit. This is far from the last regulatory change the industry is facing and firms shouldn’t view it in isolation. ‘We know that regulators globally are moving towards harmonisation,’ she said, pointing to critical data elements (CDEs): something coming into force with the EMIR Refit that has already been implemented for the US CFTC Rewrite and will also be adopted by the FCA, ASIC and MAS in the future.

Stephanie also reminded everyone about the new rules for exchanging unique transaction identifiers (UTIs).

‘In today’s world, you are able to report dummy UTIs,’ she explained. ‘So, if you are the entity that’s not the UTI generating entity, you can report that dummy UTI. That’s going away. The UTI generating entity needs to provide the UTI to their counterparty by 10 am UTC the next day.’

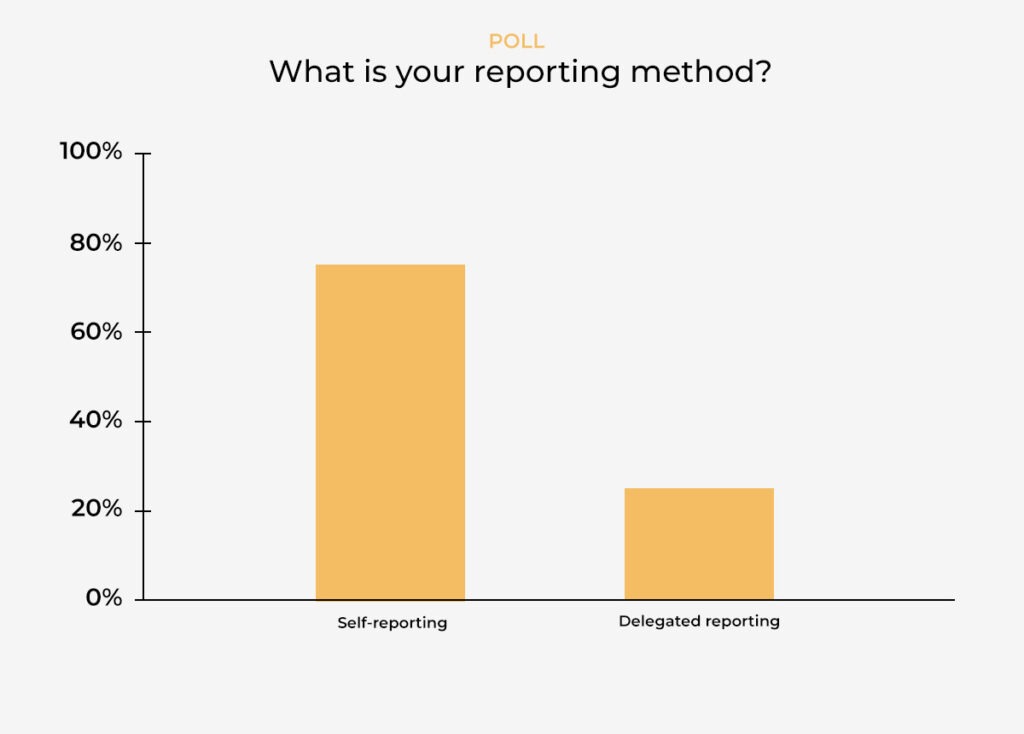

Checking data and testing processes is vital, regardless of who reports

Our second poll was a two-parter and showed an almost even split of in-house and vendor solutions being used for reporting. Steve had some good suggestions for our audience on ‘keeping your vendor honest’.

For instance, firms should consider ‘what is their ability to meet the UAT deadlines with your chosen TR, how can you validate what they’ve reported from your own requirements and reconciliation understanding and using tooling that can give you the level of detail you need to understand where your issues could be.’

‘Testing is key,’ Stephanie added. ‘There’s a lot. There’s new sequencing rules in place. There’s the new action/event types. All of these must be tested. There are ways in which the TRs will accept your trades in certain orders. You must have a position open before you can submit any modifications on top of that. This is all super important to include in your test packs. It’s important that you test all of your asset classes and products and make sure that those fields are completed and populated, based on all of your trading scenarios and those specific asset classes. There’s a lot of major changes, and you want to make sure that your test pack is updated to reflect all of these key changes.’

Carly expanded upon the idea of using the right tooling to give you an understanding and correct level of detail in your reconciliations, sharing her experience of the challenges experienced by two firms whose existing legacy technology is causing them problems as they consider the implications of the changing requirements.

‘I’ve been working with two customers that’ve been struggling with their legacy providers,’ she said. ‘One system can’t accommodate additional columns and fields, and the other happens to have so many breaks without any intelligent RCA [root cause analysis] suggestions, predictive labelling, workflow engine to appropriately route and remediate exceptions, that they can only reconcile weekly, which we know won’t be adequate with ESMA’s increased expectations around data integrity. The data quality is continuing to degrade. So we’re trying to help them out there.’

Stephanie highlighted the positives of working with a vendor and shared some words of advice for those handling reporting in-house.

‘One of the key differences of using the vendor is they do insulate you from certain types of change,’ she said. ‘So, one of the big changes here is that move to ISO. Where a firm is choosing to use a vendor, they don’t necessarily have to worry about that outbound report format. It’s just a matter of sourcing that data upstream, making sure they get all those additional data points to the vendor, and then having those additional controls in place, so additional reconciliation points, but also assurance and data validation.’

And if firms are handling reporting in-house, there are a number of extra controls they need to consider.

‘There will be additional considerations with the move to ISO, with the new reconciliation tolerance that are being enforced by ESMA, but also the enhanced scrutiny. Regulators really will be looking at all firms to make sure that their data is correct and accurate upfront. So having any extra assurance or pre-submission validations in place, especially in an in-house build, is key to making sure that your reporting is correct upfront.’

Ultimately, whichever route you’re using, our panel made it clear that you still need to perform various checks to ensure the accuracy of what’s being reported.

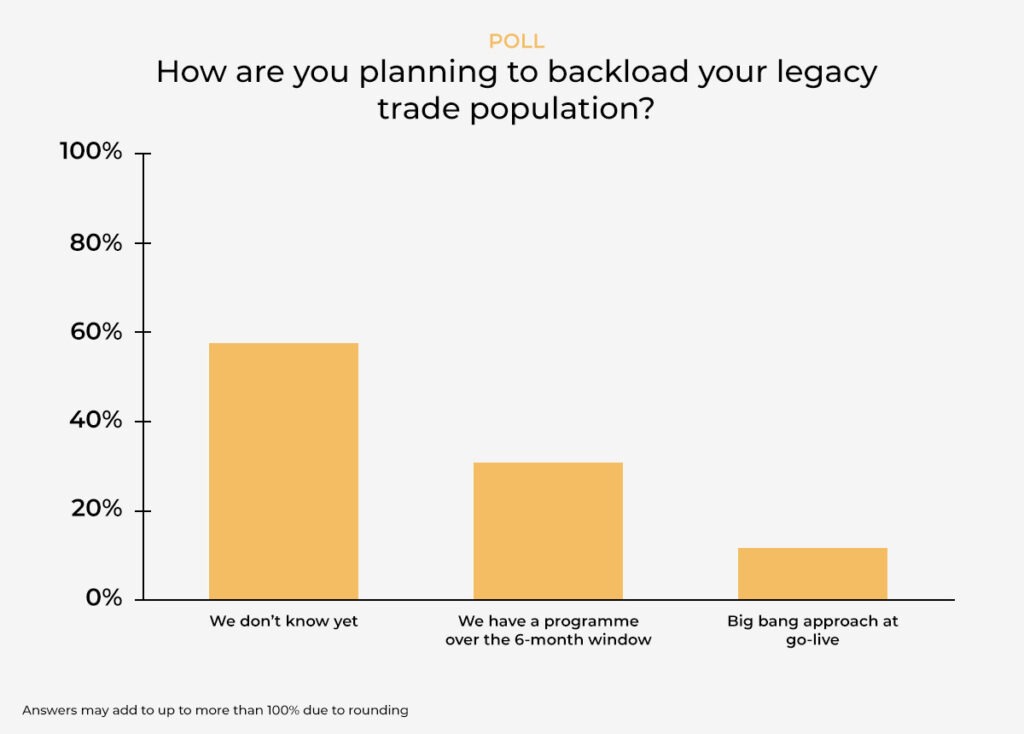

Firms still largely uncertain about legacy trade backloading approach

Under the EMIR Refit, firms are required to ‘backload’ their existing trades – reporting them in the new ISO schema and with all the additional and updated fields. This is understandably going to be a large endeavour, given that many firms will struggle to source the data to populate the new fields. As such, ESMA has given firms a six-month window in which to backload their trades.

Our third poll asked attendees how they planned to tackle this complex and resource-intensive activity. The results were surprising: well over half (58%) of respondents don’t yet know. Nearly a third (31%) have a plan in place to tackle it over the course of the six-month window, while the remaining respondents plan to backload in one ‘big bang’ at go-live.

Stephanie thought it would be tricky for a lot of firms to report within the 6-month backloading window, given the number of complexities they have to deal with. In particular, she highlights the complications that arise from EMIR’s dual reporting.

‘Let’s say, I want to update all of my trades on go-live weekend. I’m ready. [My counterparty] wants to update throughout that 6-month transition period. We’re gonna have a lot of false breaks in our reconciliations.’

How does she recommend firms prepare for such an issue?

‘I think for firms it might be good to understand, if you have a large population with a certain set of counterparties, find out what they’re planning to do and align your changes to them, so that you don’t have all these false breaks. Or, if that’s not possible, you want to make sure that you have robust reconciliations to know what breaks are false, what breaks are actually real and you’re going to need to investigate.’

‘It’s control framework again, isn’t it?’ Steve added. ‘And the quality of your reconciliation tool. Ultimately, we’re talking about what are two populations of trade, call it ‘date one and set one’, and ‘back load, set 2’, over what could be a 6 month period, understanding via your reconciliation tool where your true breaks are.’

Managing this is going to require firms to keep track of these two separate streams of reporting.

‘Effectively understanding the wood from the trees,’ Steve said, giving an example: ‘This is a day one compliant reported transaction under the new ISO format, and this is the required data set; and this is a legacy transaction that is yet to be backloaded. Being able to tranche out the false positives, to understand where your issues are, and what ultimately could cause you a problem later down the line when all bets are off on being able to reconcile and report your full portfolio correctly, is imperative.’

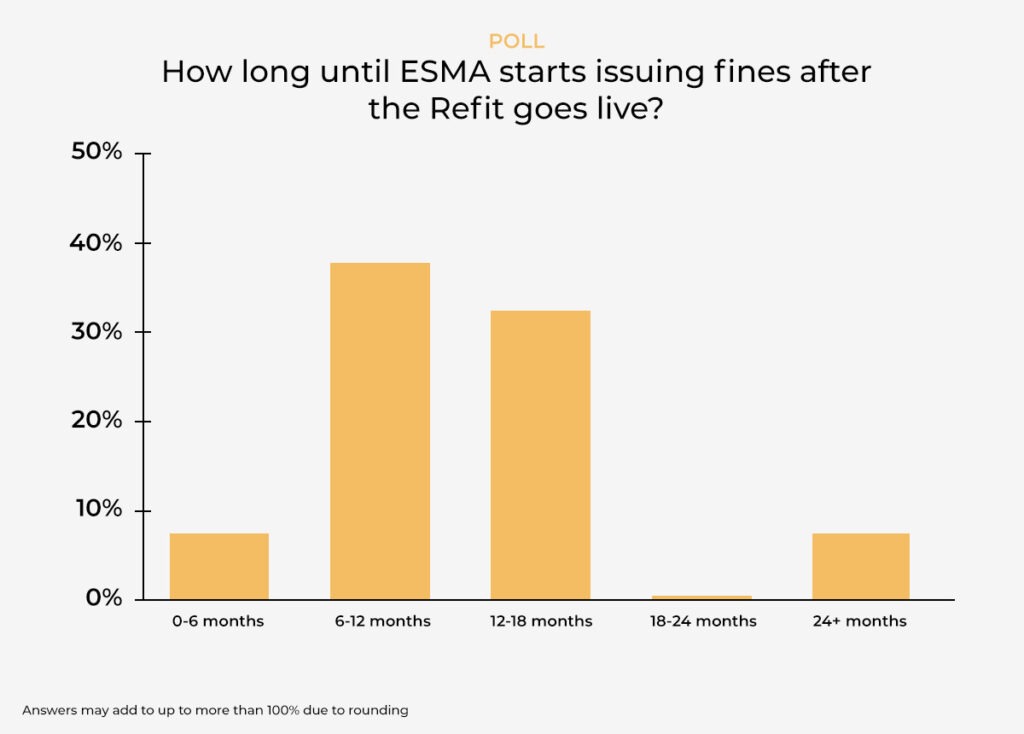

Fines 12 months after go-live?

For our last poll we asked how long our audience felt it would be before ESMA starts handing out fines for EMIR reporting errors. Most of our attendees thought it’d be within six months to a year of the Refit going live, but a large chunk expected it to take a little longer: 12-18 months. Nearly a quarter of attendees thought fines were over two years out, while seven per cent reckoned fines would start flying within six months of go-live.

Steve agreed with the estimates of our audience and warned that fines are just one part of what firms should be concerned with. Equally important, he said, was that firms have a clear idea of how they will remediate reporting errors, because along with fines will come demands from ESMA to see the plan.

‘Everyone needs to understand, one, how they’re going to report and, two, as importantly, how you’re going to reconcile, bearing in mind, you’re reconciling on a daily basis now. For prescribed fields, you have a responsibility as a reporting party, and you may have delegated that role, but you haven’t delegated the responsibility. If you’ve got issues on recon you’re required to report those to your local NCA [national competent authority]. If ESMA come knocking they want to see a remediation plan based on the issues that you have that you should be able to formally present. This isn’t just misreporting and lack of data integrity; this is not understanding where your issues are but by when you will have resolved them.’

‘It’s super important that firms start preparing now,’ Stephanie agreed. ‘It’s important that those plans get in place.’

Summary

We all know that the EMIR Refit is bringing sweeping changes – changes that many firms will struggle to tackle.

Our event showed the key role that data quality will play in helping firms prepare, keeping them compliant and minimising the impact if things do go wrong. A robust control framework is essential to meeting not only these challenges, but those of further regulatory changes coming down the road.

Want to get all the insights from our EMIR Refit event? Watch the full recording now.