Customer Innovation Day 2023: Highlights, insights and neon lights

Last month we packed out the iconic fabric club in London for a day of incredible guest-speakers, industry-leading discussions and a bold message: Change Your Legacy.

On stage with our own thought-leaders were experts from Man Group, UBS, Wells Fargo, AWS, Oliver Wyman, Jaid and Ciklum. And on the agenda was everything from the impact of AI to the need for a new operating model; one with data at its core.

Here are just some of the many highlights of the day. Stay tuned over the coming weeks as we bring you all the in-depth insights.

“What do you want to leave behind?”

“Our vision is to reduce time spent on data-related work in Finance and Operations by 90%,” our CEO, Christian Nentwich, declared as he opened the event.

The rest of the day was spent exploring the various things needed to achieve this: the technology, the attitudes, the strategies and the culture.

Christian had three main takeaways for our audience:

- Task work around data is going away. Jobs that involve reading an email, logging into a broker portal, downloading data into a spreadsheet, reconciling and validating it aren’t going to exist in the future.

- Unstructured data (which is 80% of enterprise data) is in reach for automation. There is no need to solve things like reading a contract to find out the terms manually anymore.

- Power to the people. We envision Duco as the assistant that sits next to the person doing the work. Instead of doing 100 different tasks, that person is free to make decisions and add value.

And finally, Christian reminded everyone of the tagline of our event: Change Your Legacy. He asked what our audience wanted to leave behind when they moved onto their next job, or be able to tell people that they have achieved.

The rest of the day certainly gave them plenty of inspiration.

Artificial Intelligence: the potential, the pitfalls and everything in between

It wouldn’t have been an innovation day without discussing the hottest new technology on the block: AI. Although, of course, AI has been around for a long time. Duco, for example, has been helping users match and rollup their data for years.

But the applications are becoming much broader. Head of Platform Justin Hingorani was more than a little excited to discuss the benefits and blockers with fellow experts and enthusiasts:

- Sanjeev Prabhakar-Badri, Principal, AWS Data, SaaS and Enterprise Software

- Mark Barton, CTO, Jaid

- Julian Beckers, Intelligent Automation Director, Ciklum

One of the key takeaways was a timeless piece of advice: use the right tool for the job. Our panellists explained that a lot of the fears around AI come from examples where it was used wrong.

As Julian from Ciklum noted, the market is often trying to apply GenAI to use cases where it doesn’t fit. “If you give someone a hammer, a lot of things start to look like nails,” he said.

But Sanjeev from AWS explained just why AI is so promising: unlike Robotic Process Automation, AI empowers us to automate reasoning as well as tasks.

And Mark was excited by the potential AI has to open up new avenues for the industry due to its capacity to tackle tasks so manual and effortful that no human could ever do it.

Straight from our audience

It wasn’t just our panellists sharing their insights – our audience got to have their say too via the polls we ran during the session.

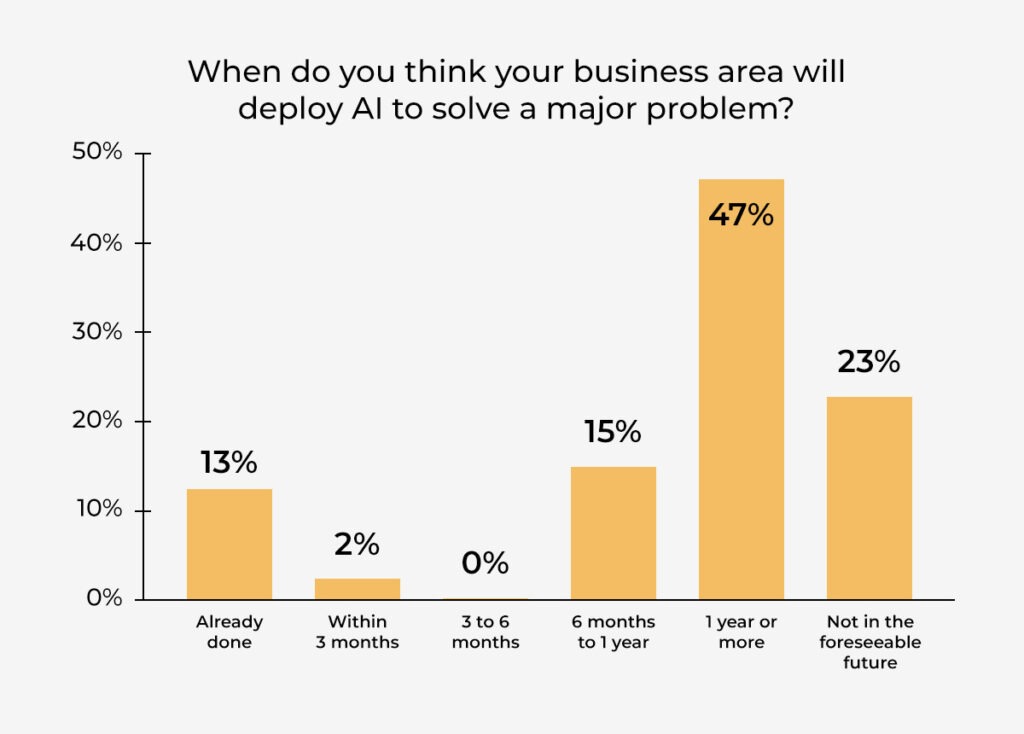

The results were certainly a mixed bag. The outlook for utilisation was surprising: while 13% of attendees are already deploying AI to solve a major problem, nearly half (47%) don’t see it happening for at least a year. A quarter still can’t foresee their business area harnessing the tech.

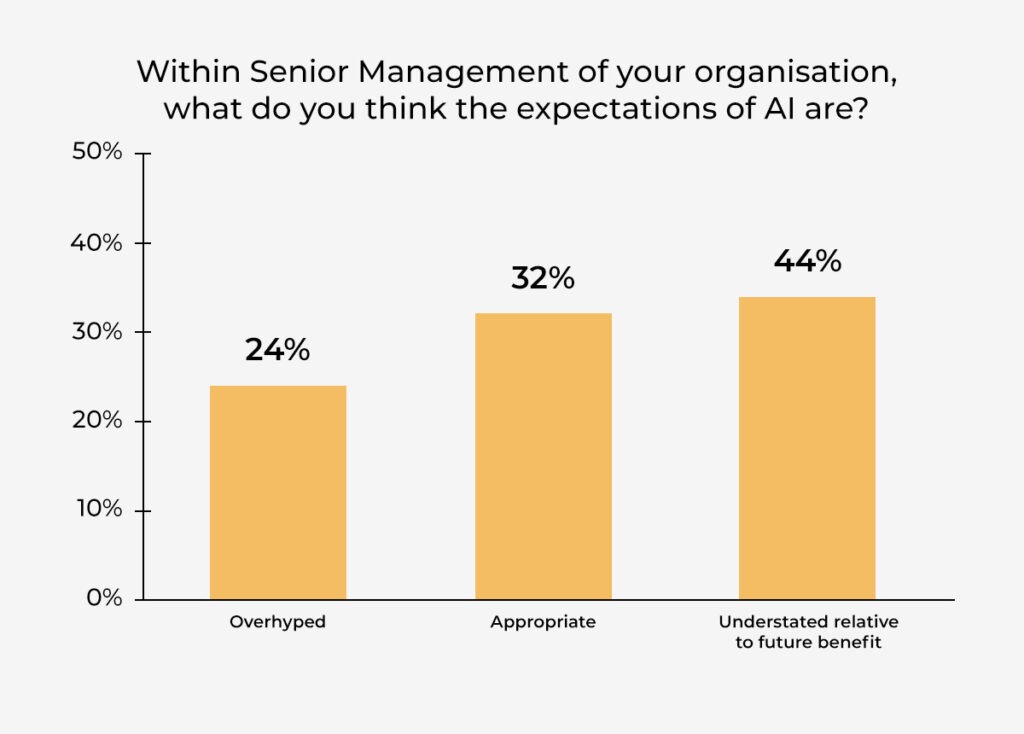

On a more positive note, the understanding of the potential of AI was much stronger. Nearly a third of our audience believe their senior management have ‘appropriate’ expectations of AI, while 44% reckon AI can do a lot more than their leaders realise.

But there are significant challenges when it comes to adoption. Our audience rated data security and privacy, data quality and integrating AI with legacy systems as their top three hurdles to overcome.

UBS, Man Group, Wells Fargo and Oliver Wyman on delivering transformation wins

It’s all very well talking about changing legacies and showcasing the latest, transformational technology available. But we all know that change can be a difficult word in capital markets, especially in operations. Everyone is well aware of the pitfalls and failed projects are everywhere.

It doesn’t have to be like that, though. Our Chief Product Officer James Maxfield hosted two enlightening sessions on transformation: a panel session with James Woodhouse from UBS, Swapnil Coelho from Wells Fargo and Chris Perks from Oliver Wyman, and a fireside chat with Richard Hunter from Man Group.

Several key themes dominated both of these discussions:

- Transformation is a journey. It’s not enough to articulate the ideal end state; you have to be very clear on the steps you’ll take to get there and the value you’ll deliver.

- Organisations need to be able to understand the problem they’re trying to solve in depth. This starts with evaluating your current state honestly.

- Transformation requires behavioural change, even a new target operating model in order to ensure everyone works together, feels responsible and is empowered to deliver.

Roundtables – what your peers think of the biggest issues facing financial services

Attendees had the chance to get around the table with their peers and discuss two of four big industry topics.

Potential of AI and ML in operations

It was clear during these discussions that there’s a buzz around AI and what it can do. But this was counterbalanced by people’s resistance to change. Concerns around data privacy and risk are prevalent and audit was mentioned multiple times. The solution here was the same as offered by panellists in our transformation talks: overcome concerns by delivering small wins.

Regulation everywhere. Are you ready?

While participants in these discussions welcomed the clarity that comes from the latest regulatory rewrites, it’s clear that firms are overwhelmed by the breadth and pace of change. Several attendees also noted that, while harmonisation between regulators is a positive step, the subtle differences in implementation are still going to cause big problems.

Creating a next-gen operating model

This kind of project is a journey and everyone agreed that it’s vital to keep people on board by managing expectations and delivering small wins along the way. Some of the challenges our participants shared included finding people to take ownership of a transformation project and overcoming issues around budgets and internal politics. Something else that came up repeatedly was how important it was to focus on understanding the current state before launching into any transformation.

Building a data-centric business

Many of those sat around the table shared that they were running at least one project internally to investigate the cause of impact of data quality upon their business. However, most viewed their data as a liability rather than an asset.

That’s all – for now

There’s no way we can cover all of the great insights and learnings from Customer Innovation Day in a single article. Stay tuned over the next few weeks as we dive deep into the topics above to bring you all the best takeaways from our special guests.

And don’t forget – Customer Innovation Day will return next year. Subscribe to our newsletter to make sure you’re in the know.